Prop trading firms have been on the rise in recent years, with more and more traders looking to make a part-time or full-time income in the financial world. There are A TON of prop firm options out on the market, but that doesn’t mean they are all good options! This is what can make it confusing and difficult to know which prop trading firms are truly worth your time and investment.

I’ve put together a list of the 7 best prop trading firms in 2024, ranked and reviewed based on factors such as reputation and actually paying traders, features, pricing, and overall performance. Whether you’re an experienced trader looking to take your skills to the next level or a newcomer to the world of prop trading, this list is sure to provide valuable insights and help you make informed decisions about where to invest your time and resources.

I am an actual day trader and fund manager, who’s been in the financial industry for almost a decade. I myself also use prop firms so I know the importance of picking the right company to trade with.

With that being said, let’s get into it.

What are the Best Prop Trading Firms?

1. Funded Trading Plus

Best Overall

Overview

Funded Trading Plus comes in among the best of the best prop firms in the industry. They have no minimum trading days, great customer service, an even better leadership team, and their profit splits are very favorable for the trader.

Their scaling plan is also unheard of. With every 10% profit, they double your account size giving you more buying power to trade with. You can scale up to a $2,500,000 account in literally just days!

You also are actually trading a REAL funded account once funded, and not a demo account which is extremely rare! What this means is that they actually WANT you to get funded and pass the challenge.

When a prop firm keeps you on a demo account once you’re a “funded trader” they’re paying you your profit split with the money everyone who fails their challenges pays to audition. By Funded Trading plus putting real funds in a live account once you’re funded it shows they actually want you to make a profit because that’s how they also make money.

P.S. I once had a Funded Trading Plus customer service rep who couldn’t help me with a problem and the managing director personally called me and answered every question I had. The care this company provides is second to none. You can tell they are in it for the long run and not just to make a quick buck!

Key Features

- Profit Split – Up to 90/10

- Minimum Trading Days – NO minimum trading days

- Profit Target – 10%

- Tradeable Financial Instruments – Forex, Indices, Commodities, and Cryptocurrencies

- Founded – 2021

- Location – London

Pricing

Starting from $119

Each challenge type and challenge size has its own unique pricing.

What I Like/Dislike:

Like:

- No time limit on challenges

- No minimum trading days

- News trading is allowed

- Challenge account sizes range from $12,500 to $200,000

- Scaling potential of up to a $2,500,000 account

- Affordable pricing

- Many different challenge types to choose from

- Verified and legitimate reviews

- Payout proof to traders

- Has a welcoming discord community

- Discounts are offered if you fail the challenges

Dislike:

- Relative drawdown on challenges

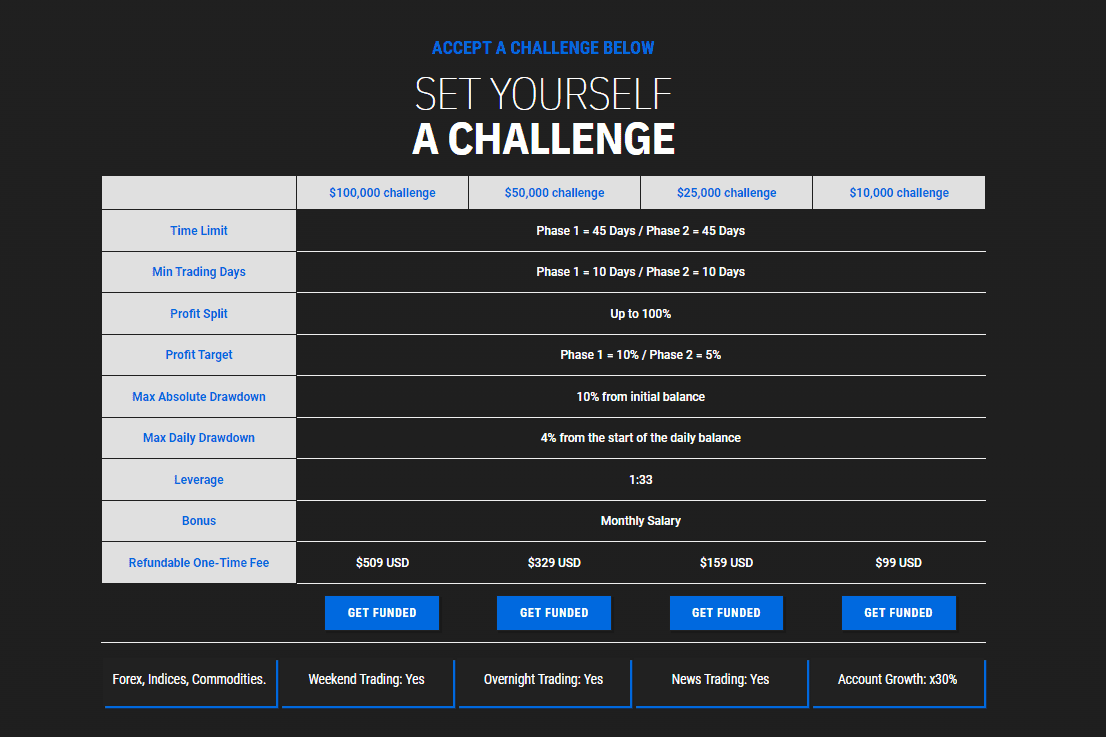

2. City Traders Imperium

Overview

City Traders Imperium is a great company which is why they are at the top of the list. They offer a wide range of funding challenge types including a 2-step, 1-step, and instant funding challenge with no evaluation at all.

The pricing is also excellent as well giving you a great bang for your buck. Not to mention they have a profit split of up to 100% once you reach a certain level!

It is no wonder City Traders Imperium has quickly become a favorite of many prop traders in the industry.

Key Features

- Profit Split – Up to 100%

- Minimum Trading Days – 10 Days

- Profit Target – 10% for Phase 1 & 5% for Phase 2

- Tradeable Financial Instruments – Forex, Indices, and Commodities

- Founded – 2018

- Location – London

Pricing

Starting from $99

Each challenge type and challenge size has its own unique pricing.

What I Like/Dislike:

Like:

- 45 days to pass each phase

- Many different challenge options

- Challenges start as low s $99

- Generous profit split, up to 100%

- News trading is allowed

- Payout proof to traders

- Discord community

- Legitimate and verified reviews

Dislike:

- No challenges above $100,000 are offered at the moment

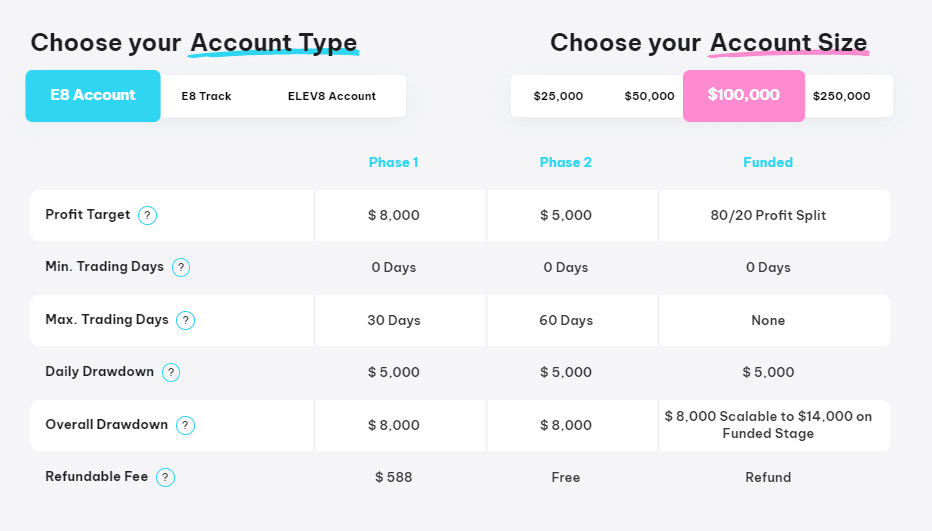

3. E8 Funding

Overview

E8 Funding offers an innovative approach to proprietary trading, giving many traders a great opportunity to manage capital.

You can increase your capital and overall drawdown each time you withdraw profits, giving you a drawdown as big as 14%, which is very unique to the industry.

Key Features

- Profit Split – 80/20

- Minimum Trading Days – NO minimum trading days

- Profit Target – 8% phase 1 & 5% phase 2

- Tradeable Financial Instruments – Forex, Indices, Commodities, Equities, and Crypto

- Founded – 2021

- Location – Dallas, TX (United States)

Pricing

Starting from $228

Each challenge type and challenge size has its own unique pricing.

What I Like/Dislike:

Like:

- No minimum trading days

- Drawdown increases with profit withdrawals

- High leverage offered

- Can scale up to $1,000,000

- Many trading assets offered

Dislike:

- Challenges are costly compared to other prop firms

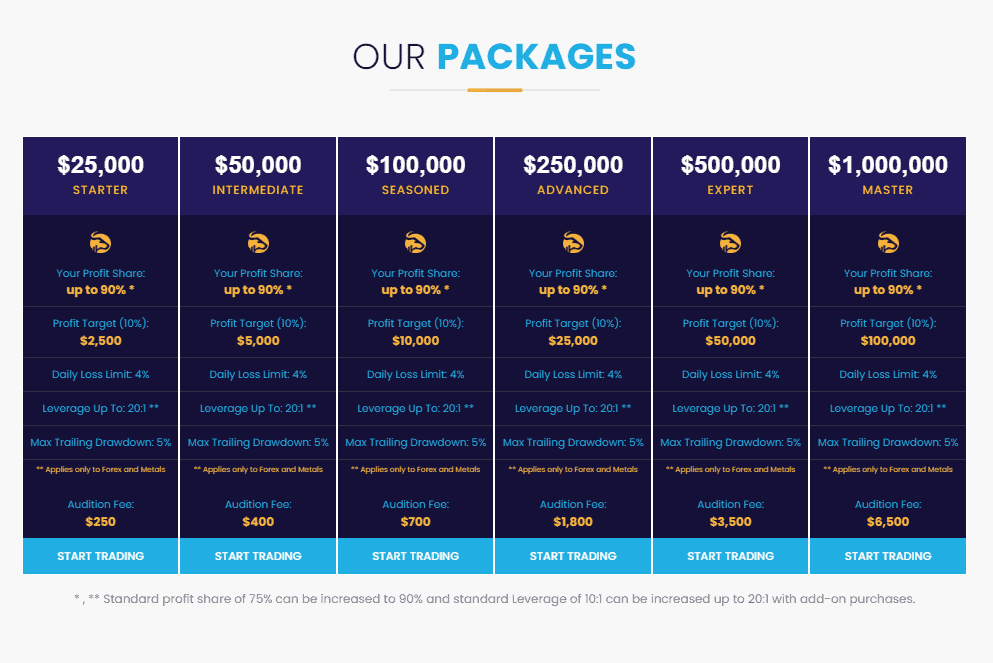

4. Surge Trader

Overview

Surge Trader is a great proprietary trading company with great technology and insights for all of their traders. The challenges are simple and straightforward.

You can purchase challenges ranging from $25,000 in size up to $1,000,000 all with the capability to pass in as little as 1 day.

Key Features

- Profit Split – Up to 90%

- Minimum Trading Days – NO minimum trading days

- Profit Target – 10%

- Tradeable Financial Instruments – Forex, Indices, Commodities, Equities, and Crypto

- Founded – 2021

- Location – Naples, FL (United States)

Pricing

Starting from $250

What I Like/Dislike:

Like:

- No minimum trading days

- Challenges ranging from $25,000 up to $1,000,000

- 1 step evaluation

- Simple evaluation process

- News trading is allowed

Dislike:

- Very expensive compared to other prop firms

- Leverage is pretty low

- Max trailing drawdown

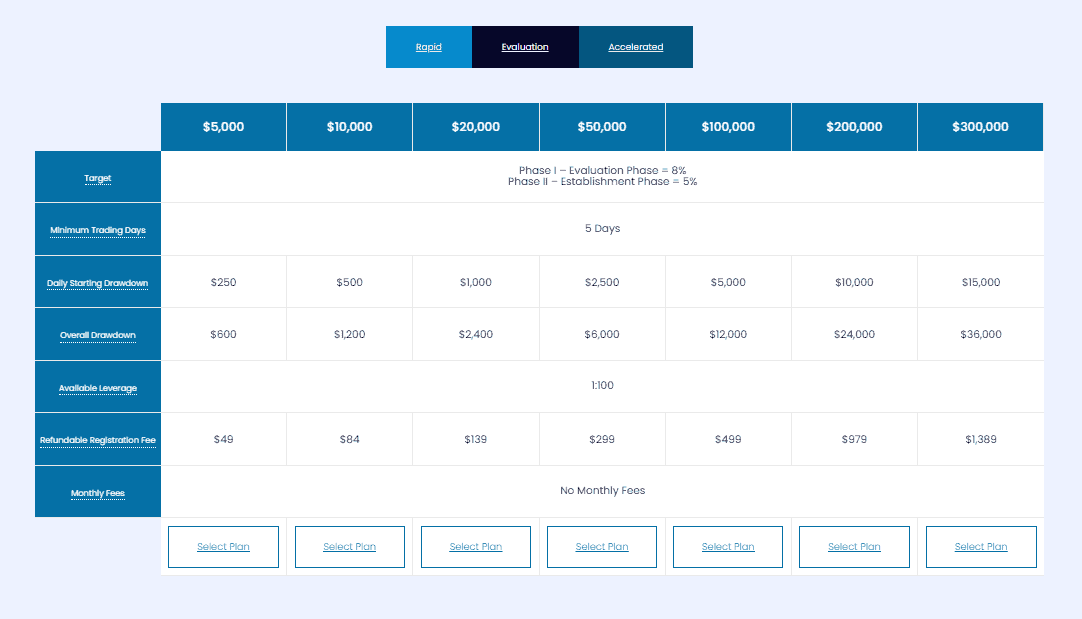

5. My Forex Funds

Overview

If you’ve been in the industry any amount of time you’ve definitely heard of My Forex Funds. They’re one of the older proprietary trading companies in the industry.

They offer a wide range of challenge sizes from as low as $5,000 up to $300,000 allowing anyone no matter their budget to participate and have a chance at earning a funded account.

Key Features

- Profit Split – Up to 85%

- Minimum Trading Days – 5 Days

- Profit Target – 8% phase 1 & 5% phase 2

- Tradeable Financial Instruments –

- Founded – 2020

- Location – Canada

Pricing

Starting from $49

Each challenge type and challenge size has its own unique pricing.

What I Like/Dislike:

Like:

- Been around for many years

- High leverage to trade with

- Account sizes range from $5,000 up to $300,000

- Multiple challenges types to choose from

Dislike:

- Spreads can be very big

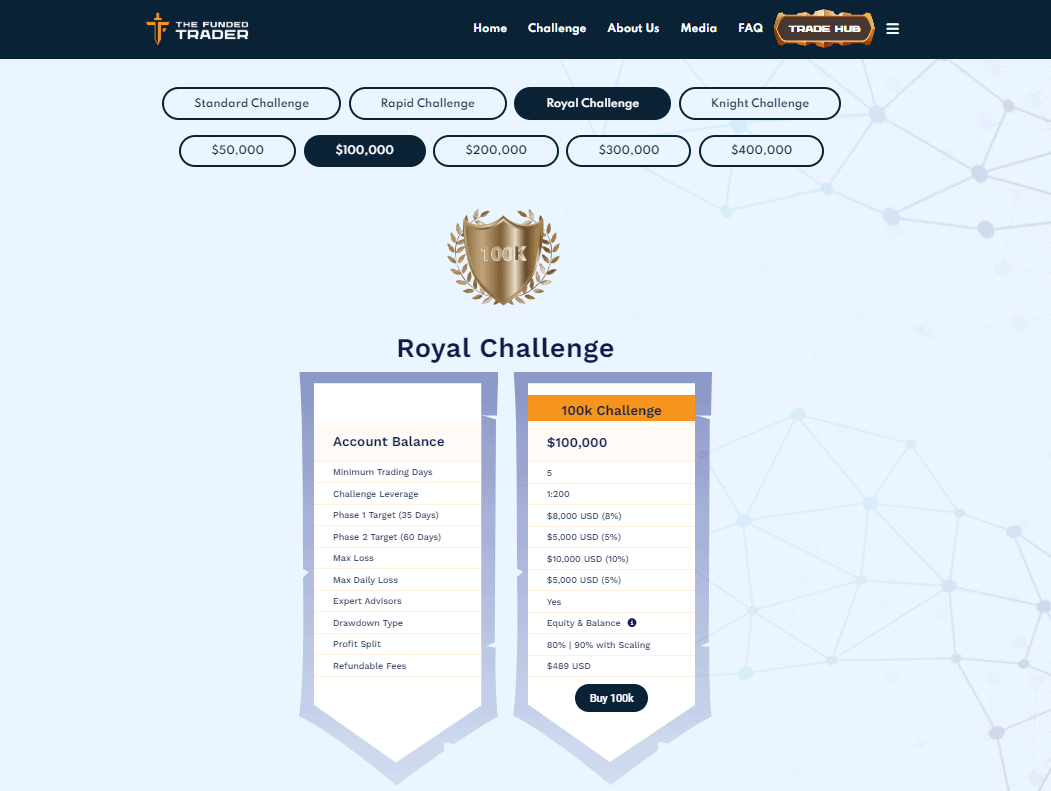

6. The Funded Trader Program

Overview

The Funded Trader Program is a relatively newer proprietary trading company that has quickly grown into one of the biggest.

They offer a wide variety of challenge types and are constantly looking to improve and innovate their challenges and technologies offered to traders.

Key Features

- Profit Split – Up to 90%

- Minimum Trading Days – 5 days

- Profit Target – 8% phase 1 & 5% phase 2

- Tradeable Financial Instruments – Forex, Indices, Commodities, and Cryptocurrencies

- Founded – 2021

- Location – Fort Lauderdale, FL (United States)

Pricing

Starting from $139

Each challenge type and challenge size has its own unique pricing.

What I Like/Dislike:

Like:

- There are a variety of challenge types

- Challenge account sizes range from $10,000 up to $400,000

- Great discord community

- Constantly offering discounts

- Customer support is good

Dislike:

- Servers experience occasional issues and interruptions

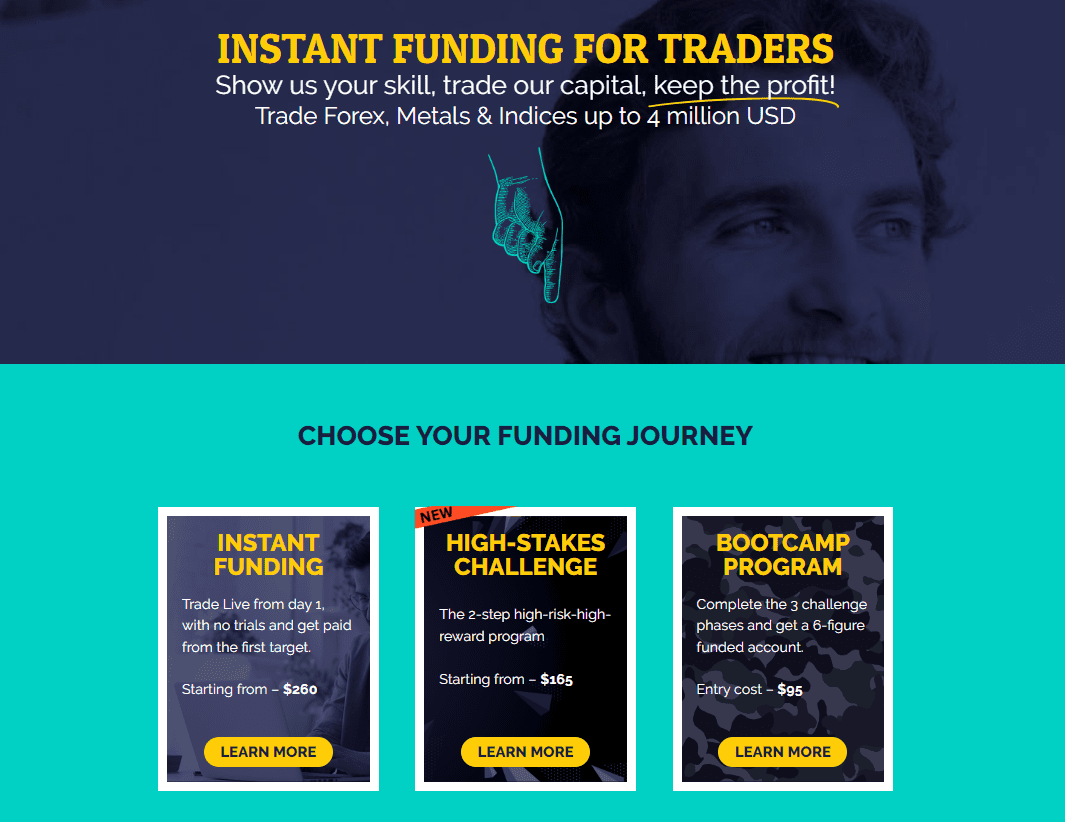

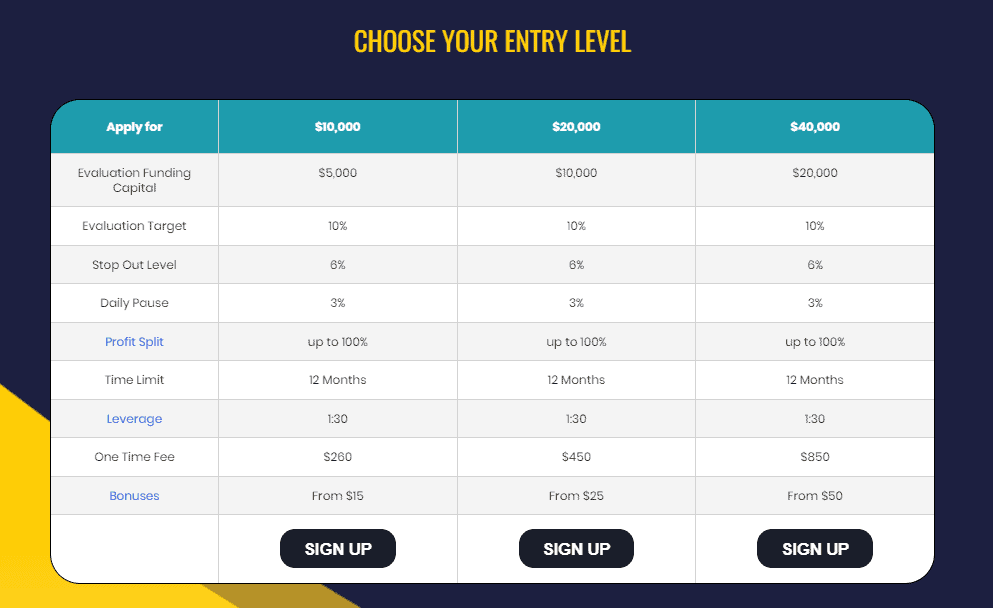

7. The 5ers

Overview

The 5ers is one of the most vetted proprietary trading firms in the industry. Having been around since 2016 they don’t seem to be going anywhere anytime soon!

They offer a variety of unique products and services giving traders many opportunities to become profitable no matter the budget you are working with.

Key Features

- Profit Split – Up to 100%

- Minimum Trading Days – 3 Days

- Profit Target – 10%

- Tradeable Financial Instruments – Forex, Indices, and Commodities

- Founded – 2016

- Location – Isreal

Pricing

Starting from $165

Each challenge type and challenge size has its own unique pricing.

What I Like/Dislike:

Like:

- Accounts are scalable up to $4,000,000

- Profit split is up to 100%

- Lots of time to pass challenges

- Legitimate and verified reviews

Dislike:

- Profit split starts off low at only 50%

- No challenges over $100,000 at the moment

What is a Proprietary Trading Firm?

A proprietary trading firm is a company that uses its own money to trade the financial markets. They partner with skilled traders who trade forex, major stock market indices, futures, commodities, or stocks on the proprietary trading firms behalf.

Proprietary trading firms usually specialize in a specific area or financial market. For example, some prop firms focus solely on forex traders while other prop firms may focus on futures traders. Each prop firm has a different area of specialty but most prop firms usually cover a wide net of trading instruments to suit each trader’s trading skills and trading strategy. While most of the prop firms in the industry are forex prop firms, they also will allow traders to trade indices, and commodities within the same trading account so don’t think you will be limited to just trading forex.

Do not be overwhelmed if you ever hear someone say “proprietary trading firm” and then say “prop trading firm” or “prop firm”. A proprietary trading firm has many names but if you ever get confused just reference the bulleted list below and know they are all just a different way of saying “Proprietary Trading Firm”.

- Proprietary Trading Firms

- Prop Trading Firms

- Trading Firms

- Prop Firms

How to become a Prop Firm Trader?

Experienced traders know that becoming a successful prop firm trader requires more than just simple trading skills. It’s about developing a good trading strategy that can deliver consistent results over the long term. To start trading with a prop firm, you’ll need to go through an evaluation process, usually, a two step evaluation process, designed by the prop firm to demonstrate your trading risk management, trading strategy, ability to follow trading rules, and overall trading skills while using a funded account. This means understanding the importance of stop losses, position sizing, and risk/reward ratios.

When going through the evaluation process, before becoming a funded trader, you will be given a demo funded account with paper “fake” money so you can demonstrate proper risk management strategies and your overall trading ability.

Once you have shown the prop trading company that you can trade successfully and responsibly manage trading capital they will reward you with a funded account to officially trade with.

What are the benefits of working with a Proprietary Trading Firm?

For experienced traders looking for a great and mutually beneficial opportunity, working with a proprietary trading firm can offer a range of benefits. As a funded trader, you will have access to some of the best trading platforms and technologies in the industry, allowing you to execute trades quickly and efficiently. Working so closely with other experienced traders can also help you learn how specific traders view the markets, what their risk management strategy is, and overall how they manage their trading account and follow the trading rules. The more you get around seasoned prop traders it can provide you with valuable insights and help you in achieving long-term trading success.

Forex and cfd traders who like swing trading may trade one way, while professional traders who prefer trading futures may trade a totally different way. None of us know everything about the market and having access to other skilled traders in the prop trading industry can be very beneficial.

Perhaps most importantly, proprietary trading firms are known for their rigorous risk management strategies, which can help to protect your investments and maximize your profits over time. Also, since you’re trading the prop firm’s capital and not your own money, essentially funded traders are risk-free once they officially become a funded trader with the prop firm and pass the evaluation process.

Overall, if you are looking for a rewarding career in trading, partnering with one of the best prop trading firms on this list could be the perfect opportunity for you.

What are the risks of working with Proprietary Trading Firms?

Traders, specifically forex traders because there are so many forex prop trading firms to choose from, can often find themselves faced with the dilemma of choosing between trading with a proprietary trading firm or trading their own capital on an independent trading platform.

While both options have their advantages, there are some risks associated with working with proprietary trading firms. Prop trading firms are known to have strict rules and regulations, and traders are expected to adhere to these guidelines at all times.

However, this can also be a great benefit if you’re looking for great risk management tactics. If you start trading with a prop trading company, you essentially are given trading rules and trading strategies you need to follow to be successful as their entire business model is built off of being profitable. This can only be done by having traders trade on funded trading accounts so the prop firm can get their commission through the profit split. So they tell you exactly what trading rules to follow and what guidelines to adhere to, to have the best chances of being a profitable trader.

Some of the best proprietary trading firms offer their traders significant benefits such as access to state-of-the-art trading platforms, educational resources, and daily market analysis reports. As a result, forex traders and other traders who choose to work with these firms can gain valuable experience and expertise, which can lead to more profitable trades in the long run.

Overall, while there are risks involved in working with a proprietary trading firm, it can be an excellent way for traders to learn how to trade forex and other financial markets successfully.

Top Things to Look for When Choosing a Prop Trading Firm?

1. Reputation

When it comes to choosing the best prop trading firms to partner with, the prop firms reputation is the FIRST thing you should look at. With little regulation currently in the prop firm industry it leaves a lot of fly-by-night companies popping up to try and make a quick profit. Often at the expense of the trader. Many illegitimate companies find reasons not to pay traders once they make a profit, or go out of business and end up never paying traders for their work.

You DO NOT want this. That’s why it’s key to choose the best proprietary trading firms you can and partner with them and not the scammers.

A reputable prop trading firm will offer access to a great trading platform, cutting-edge trading technologies, cater to a wide range of trading strategies, and most importantly have a history of ACTUALLY PAYING TRADERS consistently.

2. Capital

Not only do you need a firm with a good reputation and track record, but one that also offers sufficient capital to their prop traders to support your trading strategies. This is why selecting from the top prop trading companies in the industry is essential for success.

With the right prop trading firm on your side, you can develop your skills and grow as a trader while maximizing your earning potential. So, take the time to research and assess your options before making a decision that could impact your future as a funded trader.

3. Platform

When looking for a prop trading firm, one of the most important factors to consider is whether they offer trading platforms that meet your needs.

Prop trading firms provide a unique opportunity for traders to access significant amounts of capital and leverage to execute their trading strategies effectively. However, this can only be achieved with the right tools and technology.

A reliable trading platform should have all the necessary features to help prop traders navigate the complexities of the financial markets while executing trades in real time. It should be user-friendly, incorporating various analytical tools and charting capabilities to enable traders to make informed decisions. The industry standard trading platforms are Meta Trader 4 (MT4) and Meta Trader 5 (MT5).

By choosing a good prop trading firm with robust trading platforms to choose from, traders can leverage their expertise to maximize profits while minimizing risk.

4. Leverage and Margin

Sufficient leverage and margin, along with other factors such as trading strategies and the prop firms reputation, must be considered when doing your research to find the best proprietary trading firms that suit your needs.

With the right leverage and margin, prop traders can execute their trading strategies with more flexibility and efficiency. Especially when it comes to forex trading and the forex market as a whole, which is a highly leveraged industry, be sure to do proper research. 30:1 leverage in the U.S. is standard for most forex trading platforms.

However, not all prop trading firms are created equal and it can vary from country to country. It’s important for all aspiring prop traders to do their research and choose a good prop trading firm with sufficient leverage and margin for their needs.

5. Risk Management

With prop trading firms offering traders the opportunity to trade a funded account you can be certain they want to make sure your risk management is on point and up to par! Depending on your trading style this could either be very helpful or very intimidating.

All of us traders know that each trading style comes with its perspective win-loss ratio. Some prop trading firms have very strict drawdown rules which may not allow much room for error when it comes to losing a few trades before getting in profit. Other prop trading firms may have a higher profit target to achieve which may not be realistic for your trading style and you may find yourself trying to over risk on each trade, just to meet the profit target criteria in the allotted time frame.

By selecting a reputable prop trading firm with excellent risk management practices, you can increase your chances of achieving success along with your financial goals in the trading industry.

6. Customer Service

Last, but certainly not least, is great customer service. When selecting a prop trading firm, excellent customer service is a crucial factor to consider.

Prop trading firms are companies that provide investors with the capital to trade, and as such, clients need to have access to knowledgeable and responsive support staff. Good prop trading companies place considerable emphasis on providing exceptional customer service to their clients. They ensure that all grievances are addressed promptly and that their client’s needs are met satisfactorily.

This level of service helps foster strong relationships between the company and its clients, which is essential for the success of both parties.

FAQ (Frequently Asked Questions)

Which is the best prop trading firm?

The best prop trading firm to date, hands down, is Funded Trading Plus! This prop firm has EXCEPTIONAL customer service, they have NO TIME LIMITS and truly care about the traders achieving success. They also aren’t trying to be the biggest of all the prop firms, but rather the best prop firm they can be.

The best prop trading firm comes down to the prop firm that meets your needs ultimately. I’ve gathered the best of the best in this list but you can not go wrong by going with Funded Trading Plus

What is the best prop firm in the world?

The best prop firm in the world is currently Funded Trading Plus! The fact that they have great support, great products, and unlimited time to pass your funding challenges is unheard of.

Most importantly, they are not trying to be the biggest prop firm in the industry but rather be the best company they can be. It’s because of this that they can pay close attention to their clients and offer great spreads, products, and customer service.

Are prop trading firms worth it?

Many traders wonder if the benefits of joining a prop firm are worth it. To answer this question, it’s important to understand what prop trading firms are and what they offer.

Essentially, prop firms provide traders with capital to trade with, and in return, the firm takes a percentage of the profits earned. For some traders, this arrangement can be highly beneficial as they have access to significant capital that they may not have had otherwise. However, for others, the pressure of trading with someone else’s money can be too stressful.

Ultimately, whether or not prop trading firms are worth it depends on the individual trader’s goals and risk tolerance.

How much do prop firm traders make?

The question that often comes up is, “how much do prop firm trades make?” The answer varies depending on a number of factors, including the trader’s experience, the type of markets they trade, and the profit-sharing arrangements with the firm.

Generally speaking, traders at reputable prop firms have the potential to earn six-figure salaries or more if they consistently perform well. This makes prop trading an attractive career option for those who have a passion for finance and enjoy taking calculated risks.